How expensive is living in Germany?

Thinking of moving to Germany? Find out the average cost of living in Germany in this blog. Germany can be affordable or expensive depending mostly on where you live (city), what housing you choose, and how you’re insured and taxed. This guide gives up-to-date figures, practical tips, and city-level comparisons for a few of the largest cities in Germany (Berlin, Munich, Frankfurt, Leipzig, Düsseldorf) so you, a student, professional, family or newcomer can plan a realistic budget. All key facts are sourced and dated so you can verify them quickly.

P.S: Comparisons are subjected to changes in economic conditions

TL:DR

Munich is the most expensive city to live in Germany. Out of the five cities mentioned in this blog, Leipzig is the cheapest city to live in Germany.

- Living Expenses in Germany

- Why Germany living Expenses Vary (3 big drivers)

- Living cost comparison by City in Germany

- Line-by-line monthly budget: what you should plan for

- Taxes & net pay

- Students & short-term stays

- Money-saving tactics that actually work

- FAQ — quick answers to the most asked expat questions about costs

- Sources (live references used for the figures above)

Living Expenses in Germany

- Average 1-bed apartment, city centre (typical ranges): roughly €700–€1,800 per month depending on the city. Leipzig at the low end, Munich at the high end.

- Typical monthly living cost (single person, incl. city-centre rent): roughly €1,700–€3,000 depending largely on rent and lifestyle.

- Average household income Germany (full-time): ~€4,700 gross/month (latest Destatis series for full-time employees).

- Deutschlandticket Price (nationwide public transport): €63/month from 2026 (subject to future adjustments)

- Statutory health insurance base rate: 14.6% of income (plus fund-specific additional contribution; employer generally pays ~half (see insurers for exact amounts).

These five items are the most load-bearing figures used throughout this guide; sources are cited inline so you can click through for the latest numeric detail.

Why Germany living Expenses Vary (3 big drivers)

- Housing (rent + Nebenkosten): Biggest single expense. Market tightness and local wages differ heavily between Munich and, say, Leipzig.

- Taxes & social contributions: Germany’s payroll system deducts income tax and social insurance (health, pension, unemployment, long-term care) which significantly reduces take-home pay.

- Household & life stage: Students in shared flats (WG) pay much less; families face childcare and schooling decisions that can add large costs.

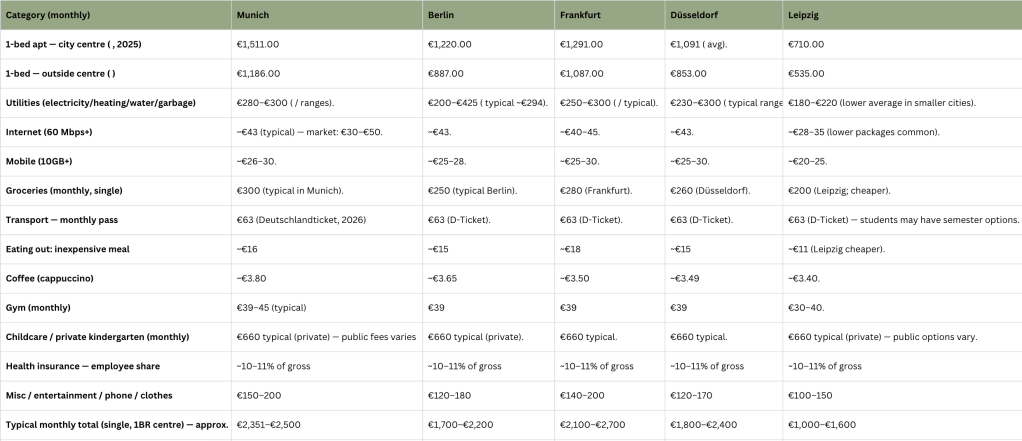

Living cost comparison by City in Germany

Is Living in Berlin Expensive?

Find out what is the cost of living in berlin looks like. Download the resource below to find out.

Is Living in Munich Expensive?

How expensive is Munich? Download the resource below to find out

Is Frankurt Expensive to Live?

How expensive is it to live in Frankfurt? Download the resource below to find out.

Is Düsseldorf Expensive to Live?

Find out the approximate cost of living in Düsseldorf. Download the resource below

Is Living in Leipzig Expensive?

Cost of living in Leipzig? Download the resource below to find out.

Line-by-line monthly budget: what you should plan for

Housing

- Kaltmiete vs. Nebenkosten: Cold rent (Kaltmiete) is the base; Nebenkosten (utilities, waste, building charges, sometimes heating) typically add €100–€300 monthly depending on apartment size. Always ask what’s included.

- Deposit (Kaution): Up to 3× Kaltmiete is standard, plan for this one-off cost.

Utilities & internet

- Average (small flat): €150–€350 monthly for electricity, heating (if not covered), water; €25–€40 for internet. Energy prices can fluctuate, so compare providers. Wise

Food & groceries

- Single person (monthly): €180–€350, depending on whether you use discounters (Aldi/Lidl) or buy organic / branded goods. Here’s how to save money on groceries.

Transport

- Deutschlandticket: €63/month (2026 price) — excellent value for regional travel and city public transport; students may have semester-ticket options at reduced prices in some regions. If you’re new to Germany, learn how to use public transport in Germany

Health insurance & social contributions

- Public health insurance: base rate 14.6% + fund supplement; employer pays ~half. Employee payroll deductions for all social insurance components (health, pension, unemployment, nursing care) commonly total ~20–22% of gross pay (varies by salary & contributions).

Other (phone,internet, leisure, clothing, incidental)

Estimate:€100–€250 per month for a modest lifestyle.

Taxes & net pay

Average gross to net: With Germany’s progressive tax system plus social contributions, you commonly lose ~30–45% of gross salary to taxes and social charges (exact share depends on tax class, children, church tax, private insurance). Destatis provides up-to-date gross wage stats to compare with your offers.

Students & short-term stays

- Shared flats (WG): Typical student rooms in a WG are €250–€600 depending on city and quality, by far the cheapest option for newcomers. Wise

- Semester & student tickets: Many universities include low-cost semester tickets; the nationwide Deutschlandsemesterticket and local agreements are evolving, check your university’s announcements.

Looking for an apartment in Germany? Read the article How to find apartment in Germany.

Money-saving tactics that actually work

- Live outside the city centre and factor commuting cost vs. rent savings.

- Shop discounters (Aldi, Lidl, Netto) for staples.

- Compare electricity/gas providers (switch when contracts end).

- Use the Deutschlandticket for commuting rather than driving.

- Ask your employer about relocation support, transport subsidies or language course reimbursement.

For more money saving tips, check out this blog, How to save money in Germany.

FAQ — quick answers to the most asked expat questions about costs

- Is Munich always the most expensive? Usually yes for rents and many consumer prices; wages are higher too.

- Can I live on €2,000/month net in Germany? In Leipzig or smaller cities: yes. In Munich or some central Berlin neighborhoods: likely tight unless you share.

- Is health insurance unaffordable? Mandatory but employer shares the load; many people pay public insurance via payroll deduction. For freelancers/privately insured persons, premiums can be higher – always compare options

Sources (live references used for the figures above)

- Wise – Cost of living city pages (April 2025 snapshots / city tables) — Berlin, Munich, Frankfurt, Leipzig, Düsseldorf. Wise

- Numbeo – city rent & cost averages (2025 pages) — Berlin, Munich, Frankfurt, Düsseldorf, Leipzig. Numbeo

- Deutsche Bahn / official Deutschlandticket pages (D-Ticket price €58 in 2025; announced change to €63 Jan 2026). Deutsche Bahn

- German health insurer pages / PKF social insurance summary (statutory 14.6% health contribution, average Zusatzbeitrag ~2.5% in 2025; employee share ≈ half). Die Techniker

- Supplemental reporting on rents & policy: Reuters / Guardian coverage on rental markets (context for rent pressure and supply). Reuters

Need a guide on How to save money in Germany? Here’s your guide

Leave a comment